OPINION

School bond proposals—what they don’t tell taxpayers

Published June 21, 2024

Written by Athens

Photography by Simply American

WHEN SCHOOL BOND PROPOSALS CLAIM THERE WILL BE A ZERO INCREASE IN TAXES, IS THERE STILL A COST TO VOTERS?

What Is A School Bond?

“A bond proposal is how a public school district asks its community for authorization to borrow money to pay for capital expenditures like new construction, additions, remodeling, site improvements, athletic facilities, playgrounds, buses, furnishings, equipment, and other capital needs.” —Jenison Public Schools, February 25, 2024

Chalkbeat, an education reporting site, explains it further: “A bond request on a ballot… is usually asking two things: can the district take on more debt, and can the district increase your property taxes to pay off that debt?”

Allendale Public Schools (APS) has a bond proposal on the ballot for the upcoming election on August 6, 2024. The district is looking to take on a loan for $88.27 million to pay for building and parking lot upgrades, as well as a new field house with artificial turf, team rooms, a weight room, a new stadium entrance, and ten new tennis courts.

As other schools have done, APS is marketing the proposal with an emphasis on zero tax-rate increase.

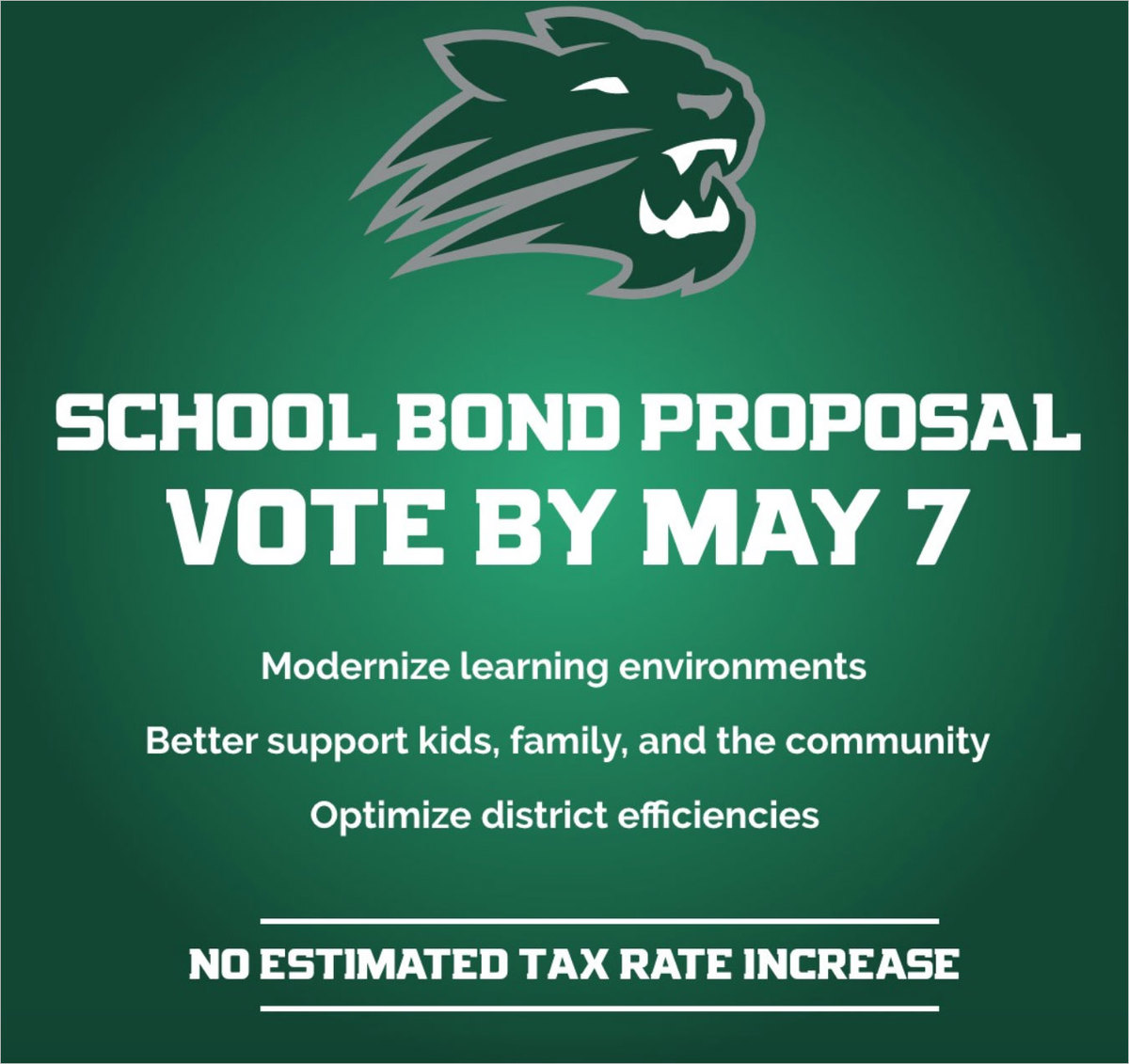

Two examples of bond proposal advertising:

Allendale Public Schools 2024 bond proposal flyer.

Jenison Public Schools 2024 bond proposal flyer.

ZERO TAX-RATE INCREASE DOES NOT MEAN ZERO COST TO THE TAXPAYER.

In the case of APS and most schools requesting a bond, what prompts the proposal for a new bond is that the current bond is expiring. When the current bond expires, property taxes would go down if there is no new bond to take its place. Schools would continue to receive tax dollars through the current millage but would not receive the additional dollars coming from a bond.

If a bond proposal passes, taxes will continue at the higher rate imposed by the previous bond, rather than return to the rate of the millage.

If the bond passes, what does that mean for a homeowner?

The average homeowner in Allendale, for example, pays approximately $2000 per year in property tax for the current school bond. With the passing of the bond proposal that will be on the ballot, the homeowner will be required to pay that additional $2000 per year for ten years longer. That is roughly $20,000 additional in property tax each homeowner will be contributing to the proposed bond, and that’s not considering the impacts of inflation.

If the bond passes, what does that mean for a renter?

Similarly, the bond will affect the landlord who owns the rental, requiring the continued payment of the higher tax rate. The landlord most likely would need to raise rent or keep the rent higher to compensate for the additional cost.

What happens if the bond proposal fails?

If the bond proposal fails, once the current bond expires the property taxes go down—back to the millage tax rate.

Bonds fail often. Of the four school bond proposals that were on the ballot across Ottawa County in May of 2024, three of them failed. When bonds fail, school administrators typically go back to the drawing board and rework the proposal, looking for places to cut spending or for other sources of revenue.

Alternative Funding

In April of 2024, Rocket Mortgage put out a report ranking states on property tax. Michigan came in at 38—in other words, 37 states have lower property taxes than Michigan.

Continuing to pay high property taxes is not the only way we have to support our children and the schools.

A citizen’s ballot initiative called AxMiTax proposes we define property tax differently.

AxMiTax: a citizen's ballot initiative to completely eliminate property tax.

On the AxMiTax website, they state that there are 1000 ways to fund schools, police, fire, libraries, etc., without leveraging personal property.

AxMiTax Founder Karla Wagner says: “If you want the government to spend less money, you have to send the government less money to spend.”

Wagner asks people to consider the consequences of voting to increase the property taxes going to the schools.

“IF YOU’RE GOING TO VOTE YES ON A MILLAGE [OR BOND],” WAGNER SAYS, “YOU’D BETTER BE THINKING ABOUT YOUR NEIGHBOR. CAN YOUR NEIGHBOR AFFORD IT, OR ARE YOU GOING TO PUT HIM OUT OF HIS HOUSE?”

AxMiTax has a petition nearing the circulation deadline. You can read more about their thoughts on personal property tax on their website.

August 6, 2024

Following are the school bonds and millages on the ballot for August 6, 2024:

• Allendale Public Schools: Bond Proposal

• Coopersville Area Public Schools: Operating Millage Renewal Proposal

• Grand Haven Area Public Schools: Sinking Fund Millage Proposal

Voters Can Still Support The Kids And The Schools

Bonds and millages go toward facilities and operating costs. We need to put our money toward what our children are learning. Let’s get the focus off the facilities and instead focus on the hearts and minds of our next generation.

Money talks. If schools don’t get our money, maybe they’ll start listening to us when it comes to keeping the indoctrination, Elliot Larsen agenda, and sexualized content out of our schools.

On August 6, 2024, taxpayers have the opportunity to send a message with their vote.

The opinions expressed within this article are the author’s and do not necessarily reflect the positions and beliefs of Simply American or its affiliates.